How To Use Fiscal Sponsorship To Expand Your CSR Initiatives

Fiscal sponsorship is a great way to navigate the complexities of your business’ charitable project.

In today’s corporate environment, businesses are becoming increasingly interested in finding new and creative ways to contribute positively to society – and we’re here for it. But with that comes other challenges, such as a blurred line between for-profit businesses and their corporate social responsibility projects. (Can/should they accept donations? And if so, how would they go about doing so)?

One strategy businesses can take to address this challenge is by finding a fiscal sponsor to operate their charitable project as if it were a nonprofit organization.

But before we dive in, let’s get you caught up on what fiscal sponsorship is.

What is Fiscal Sponsorship?

Fiscal sponsorship is when a nonprofit sponsor (such as Mission Edge) invites a charitable mission to operate under its tax-exempt status. This arrangement allows the charitable mission to focus on fundraising and community service, while the sponsor handles administrative responsibilities, from financial management to HR operations. Fiscal Sponsorship can be a helpful tool for charitable missions, even if they’re operated by for-profit businesses, because it offers a streamlined way to access charitable funds and operate efficiently.

For a deeper understanding of Fiscal Sponsorship and how it can benefit social ventures, read our blog about fiscal sponsorship benefits and costs, or our blog about fiscal sponsorship vs. nonprofit formation.

Partnership between Corporate and Nonprofit Worlds

Employees care more about making an impact than ever before, so it’s crucial for businesses to incorporate social responsibility into their priorities, and – in some cases – find a fiscal sponsor to support a charitable mission or project they’ve been working on.

Here are two reasons fiscal sponsorship may benefit your business:

Shared Resources and Expertise: Working with a fiscal sponsor can leverage your business’ strengths, so staff can focus on what really matters instead of the administrative tasks associated with a charitable project that can often complicate timelines and processes.

Access to New Funding Opportunities: Collaboration with a fiscal sponsor can open doors to new sources of funding, including government grants and philanthropic donations specifically earmarked for collaborative projects.

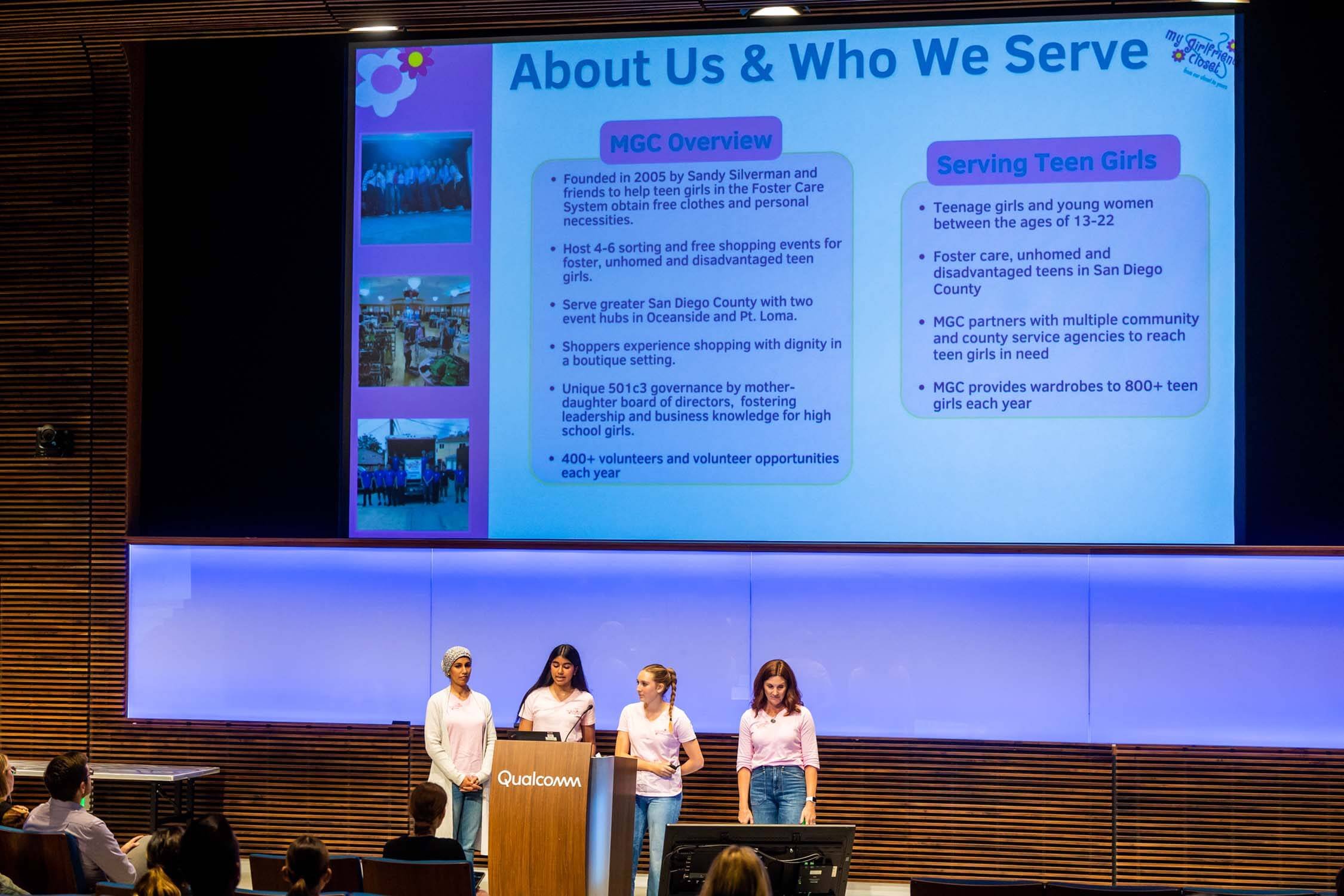

How Fiscal Sponsorship helped this museum accept funding

The Nautical History Gallery Museum, led by Joe Frangiosa Jr. – a military veteran and the principal artist – offers an up-close journey through the evolution of naval ships from the Revolutionary War to the beginning of naval aviation.

In October 2022, NHGM was poised for expansion, thanks to a significant pledge. However, without nonprofit status, the museum found itself at a standstill, unable to accept the donation that could propel it forward. Recognizing the alignment between NHGM's mission and our own, Mission Edge stepped in to provide fiscal sponsorship under our Community Give Back program.

This partnership has not only facilitated NHGM's expansion but has also bolstered its fundraising capabilities, enabling it to launch a giving campaign, create a dedicated donation page, and secure multiple grants and nominations.

If your charitable project is facing similar hurdles in accepting donations, it might be time to consider the advantages of a fiscal sponsor.

Fiscal Sponsorship: A Gateway to Corporate Social Responsibility

Fiscal sponsorship allows businesses to leverage the existing infrastructure and expertise of a nonprofit sponsor, reducing overhead costs and administrative burdens businesses often face when operating a charitable project or mission. This arrangement not only enhances the corporation's ability to focus on its philanthropic goals but also fosters a more impactful corporate social responsibility strategy.

This approach allows for:

Direct Engagement with Community Initiatives: Through fiscal sponsorship, corporations can directly support specific projects that align with their CSR objectives, fostering a closer connection with community needs.

Strategic Use of Donated Funds: Fiscal sponsorship provides a transparent and accountable framework for managing donated funds, ensuring they are used efficiently and effectively for their intended purposes.

Enhanced Corporate Image: By supporting impactful community projects, companies strengthen their reputation as socially responsible entities committed to making a difference.

Fiscal sponsorship offers a flexible and impactful way for companies to extend their CSR efforts beyond traditional avenues, enabling them to contribute to the community in meaningful and lasting ways.

Aligning with the Bigger ‘Why’

When companies integrate fiscal sponsorship into their CSR strategies, they not only address immediate community needs but also align with their deeper corporate 'Why'. This alignment goes beyond offering services or products for free; it encompasses a broader commitment to societal change related to the company's core mission.

For instance, a med-tech company might use fiscal sponsorship to provide its technology for free to those who need it most, or to support initiatives that have a broad impact on mental health, even if those initiatives don't directly involve the company's products. This approach reflects a commitment to the 'bigger WHY' of improving societal well-being, demonstrating how fiscal sponsorship can expand a company's impact far beyond its immediate business interests.

Fiscal sponsorship represents a powerful tool for companies seeking to enhance their corporate social responsibility efforts.

By bridging the gap between for-profit businesses and nonprofit missions, fiscal sponsorship allows companies to contribute meaningfully to societal welfare while leveraging the expertise and infrastructure of nonprofit partners. This strategic approach not only amplifies the impact of CSR initiatives but also aligns corporate actions with broader social goals, fostering a more sustainable and equitable world.

Explore the Potential of Fiscal Sponsorship with Mission Edge

By partnering with Mission Edge, your business can navigate the complexities of charitable engagement so you can make a lasting impact on the communities you serve. Discover how fiscal sponsorship can enhance your corporate social responsibility strategy today.