From Overwhelmed to Managed Growth

Alicia Fox is passionate about helping her clients achieve a healthy lifestyle. While growth is a good thing, Alicia and her two employees were feeling overwhelmed by the size of their new business, and the growing to-do list that went along with it.

Burger Pop-Up to Thriving Catering Business

In December of 2020, Irani started Rombomb Burger, a San Diego catering business he hoped to expand into a thriving mobile burger joint. But trying to provide for his family with a patty-flipping, burger-slinging business during a pandemic proved tricky at best. Here’s how our finance experts helped Romin add a little meat to his budding burger business.

How This Brazilian Food Business Streamlined Its Offerings

Due to their expertise in Brazilian cuisine, Jane and Eduardo had no problem coming up with a large variety of products to offer their customers. But over time, they began to have difficulties keeping up with inventory management and allocating time. Mission Edge helped them to have a more accurate perception of their business costs and future growth opportunities.

When Small-Business Finances Feel like a Different Language

Mission Edge helped Laura Valdés, founder of Valdés Language Services, make future growth financially possible. From improving her marketing to cultivating clear plan for hiring contractors and growing her business, our finance expert Carolynn helped Laura gain clarity around how to make running her business sustainable.

Ask the Experts: How Do I Make a Budget?

Ready to give budgeting a try, or ready to up-level your money skills? Check out one of these resources recommended by Impact Lab’s financial experts, and let us know what you think!

Striking a Match on Success

How Mission Edge helped Michelle organize her finances and grow her candle business. When she started working with Mission Edge, Michelle had been in business for over 2 years. She wanted to increase her revenue, but her accounting and bookkeeping methods were outdated.

How This Coach Achieved Financial Fitness

When lifestyle and fitness coach Shaniece Benson first started working with us, she needed help with financial management. All of her financial statements lived in PayPal, and she hadn’t yet nailed down a system for organizing her receipts, leaving her feeling overwhelmed and scattered.

From Mental Blocks to Money Moves

A life-long lover of fitness, Latoya McKelvin has found purpose in unlocking compassion “one pelvic curl at a time.” Latoya wants to increase revenue and grow her business. But in order to reach those goals, she needed to examine the roadblocks that were preventing her from getting there.

From Seeing Red to Visions of Progress: Navigating Debt & Livable Salaries

This networking company made a plan to get out of debt and improve member retention — while paying themselves a livable salary.

How This Business Consultant Avoided Burnout

Sara Rosales believes in the power of collective community support.

Sara is a business Consultant and the founder of Mujerex Enterprise LLC, an organization that’s focused on helping women and minority business owners with business entity formation, formation strategy and planning.

San Diego Small Business Growing from Good Soil

Danicka Brown-Frazier, Co-Founder of San Diego-based cannabis accessories and lifestyle brand Greenish Brands, has ambitious goals for her business – like doubling her revenue every year through 2027. However, before focusing on significant growth, she knew she had to address foundational issues with her finances.

A Healthy Serving of Growth

Naria Le Mire is a registered dietitian and nutrition coach who’s passionate about helping her clients break the “diet” cycle and find out how to make all foods fit. She creates individualized nutrition plans for her clients to meet their individual goals, from sustainable weight loss to FODMAP-friendly and everything in between.

These Ten Small Business Owners Used a CFO to Get Unstuck

We served 59 small business owners in 2022, and we are blushing with pride at how much they triumphed after working with us in the Impact Lab. Here’s how a handful of our entrepreneurs gained financial freedom and grew their businesses with the help of our finance experts last year.

How This San Diego Solopreneur Went from “Side Hustler” to CEO

Rolando Berring is an Impact Lab entrepreneur whose designs — and passion— make him stand out from the crowd.

He’s the owner and designer behind Berrprintz, a custom Etsy shop that offers printed t-shirts, hoodies, backpacks, hats and more.

How Taking a Step Back Was a Huge Step Forward for This San Diego Small Business Owner

For Chris Brown, gaining financial clarity in the Impact Lab created room for growth. Chris found himself getting bogged down in the logistics of running a small business. When he joined us in the Impact Lab, our goal was to address some of his current challenges while freeing Chris up to work “on” his business rather than “in” it.

Mission Edge celebrates this solopreneur as her business takes off

How Mission Edge partnered with Ruth Young in the Impact Lab to set her business up for growth in 2023.

Impact Lab entrepreneur takes an intentional approach to fitness and finance

How Impact Lab entrepreneur Stephanie Butterfield, of Activate House, tweaked her business’ finances in pursuit of a refined vision.

This San Diego Baker Is Embracing Tradition As She Invests in the Future

How Mya’s Catering Company gained financial clarity and planned for future success.

Helping Foster Impactful Leaders through the Impact Lab

Elisa Summiel, owner of Illustrated Melanin, was able to tap into her unique skill set and grow her business after working with The Impact Lab.

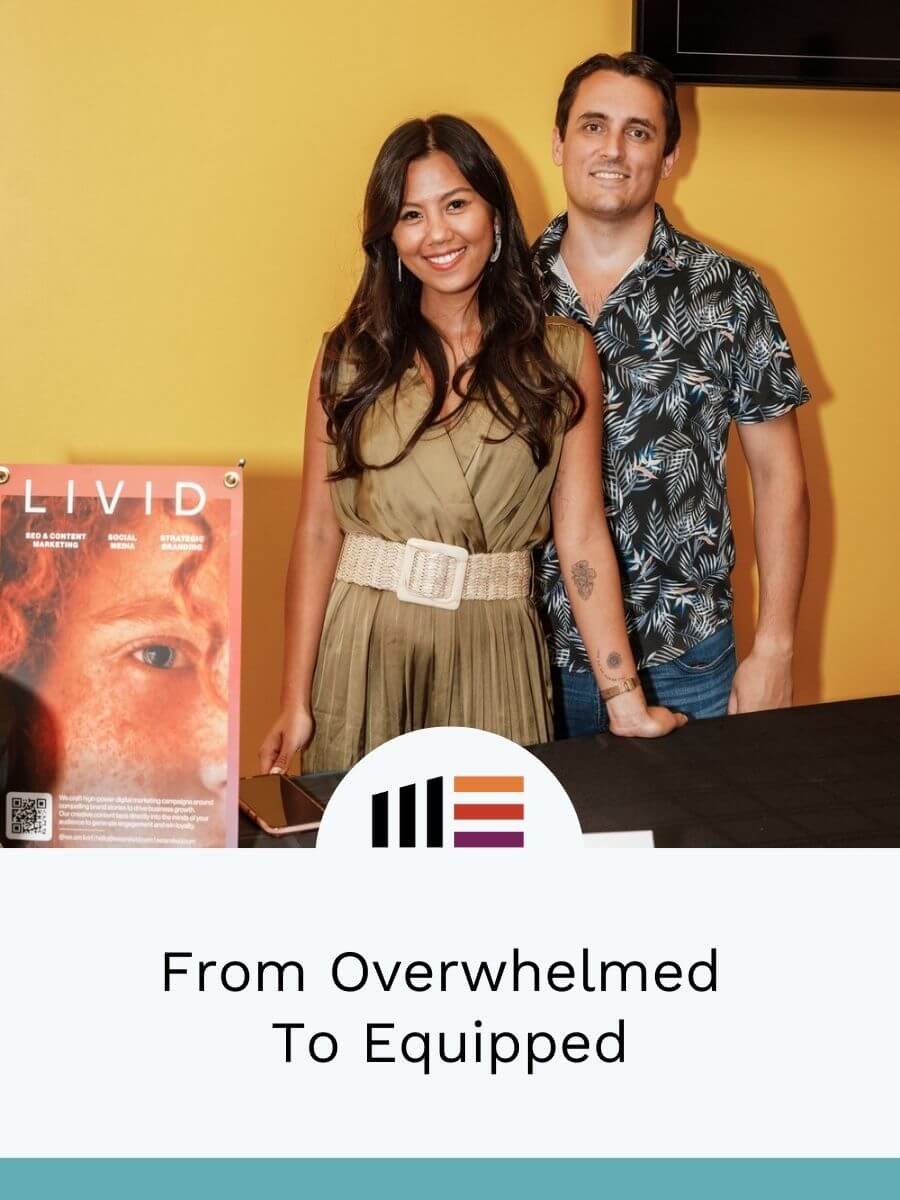

From Overwhelmed to Equipped

How Jason and Poppy Wurz, the couple behind creative marketing agency LIVID, worked with experts from the Impact Lab to lay a strong foundation for their growing business.